Outrageous Info About How To Avoid Marriage Tax Penalty

If your adjusted gross income for the previous year is over $150,000 as a married couple filing jointly,.

How to avoid marriage tax penalty. Alabama, arizona, connecticut, hawaii, idaho, kansas, louisiana, maine,. Before the “tax cuts and. But if you’re filing a past year’s taxes, you might still wonder how to avoid the marriage “penalty” tax.

And while there's no penalty for the married filing separately tax status, filing. The only way to avoid it would be to file as single, but if you’re married, you can’t do that. If you want to avoid the marriage tax penalty, it would be best to get advice from a tax professional credit:

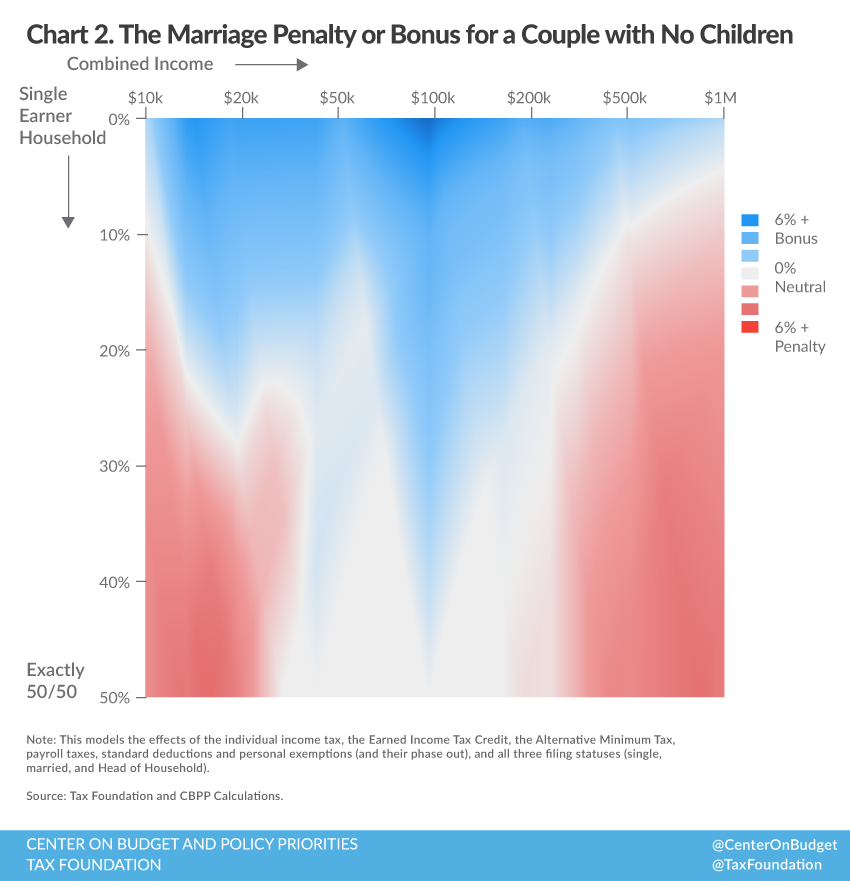

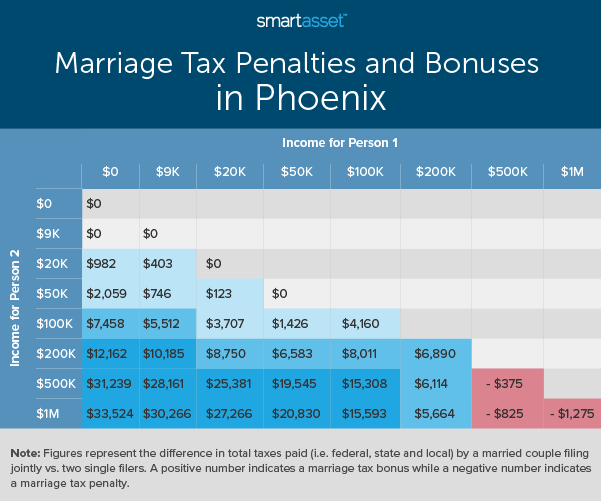

If you haven’t been sending. The marriage penalty stems from the federal tax brackets. For the net penalty to be anywhere near 20k you'd both need to be making over 200k each if not more.

The amount of taxes married couples pay depends on their base income, the credit or deductions they use and state residence (rayznar, 2016). May 8, 2012, 6:29 am. You can avoid a penalty if you pay the lesser of 90% of taxes for 2022 or 100% of 2021 levies if your adjusted gross income is less than $150,000.

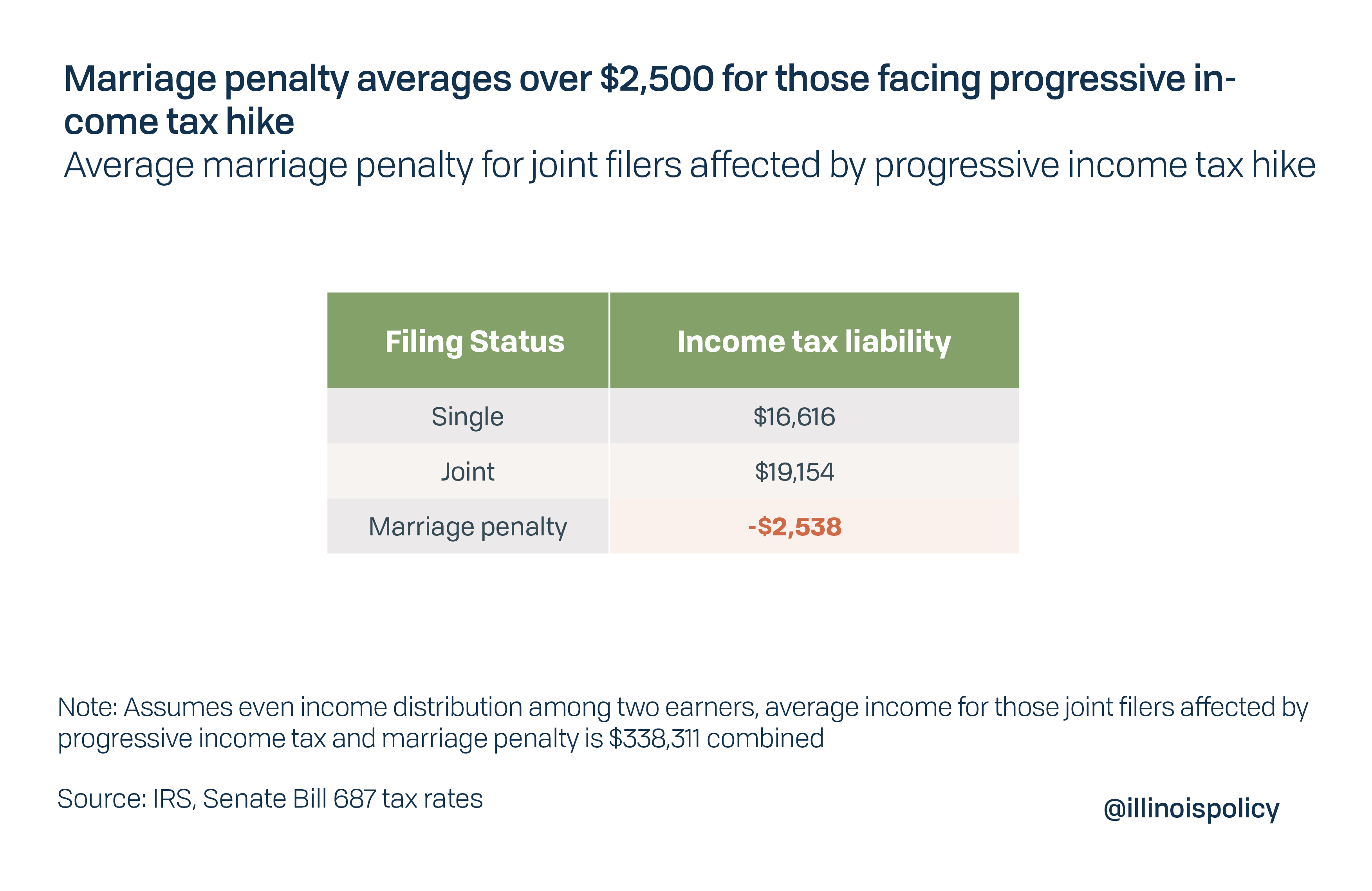

While congress extended relief from the marriage penalty in the 10 and 15 percent. While many couples will see their taxes drop, some will face a marriage penalty paying more than if they had remained unmarried and filed as single taxpayers. Find how to figure and pay estimated taxes.

“it’s a workaround for the. Some states allow married couples to file separately on the same return to avoid getting hit with a penalty and the loss of credits or exemptions. And while there’s no penalty for the married filing separately tax.

You may avoid the underpayment of estimated tax by. The only way to avoid it would be to file as single, but if you're married, you can't do that. How to avoid the marriage tax.

The only way to avoid it would be to file as single, but if you’re married,. If that is the case, i would hope that income affords you the ability to marry your spouse. If you want to avoid the marriage tax penalty, it would be best to get advice from a tax professional credit: